Economy & Trade

How Indian Exporters Can Offset Trump Tariffs Using US Foreign-Trade Zones

04/15/2025Amid Trump-era tariff tensions, Indian analysts see import-export opportunities via the US Foreign-Trade Zone (FTZ) system, as the central government launches a national help desk to support its domestic traders.

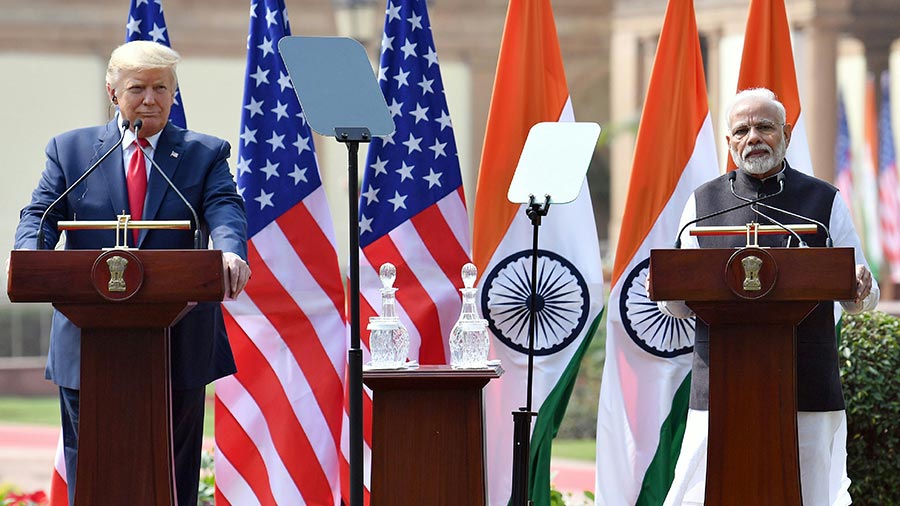

India Gains Temporary Relief as Trump Suspends Reciprocal Tariffs for 90 Days

04/09/2025India receives temporary relief from the 26 percent US import duty as Donald Trump announces a 90-day suspension of reciprocal tariffs on all countries except China on April 9, 2025.

US Hikes Tariff on Indian Imports to 26%: All You Need to Know

04/04/2025The US has announced sweeping tariffs, with a 26 percent duty on Indian products. While key industries like gems and jewelry, textiles, and agriculture are likely to face disruption, India’s pharmaceutical sector remains exempt from these tariffs.

India-Australia Deepen Economic Ties with Ambitious 2025 Roadmap

04/03/2025Australia’s new roadmap, unveiled in 2025, aims to strengthen trade and investment ties with India by focusing on high-potential sectors, promising economic growth and enhanced collaboration.

India's FTA Network: Updates in 2025

04/02/2025India is actively engaging in trade discussions with major partners such as the US, UK, EU, and ASEAN. We bring you the 2025 updates on India's evolving FTA landscape.

Profiling India-Singapore Bilateral Trade and Investment Relations

03/26/2025India and Singapore are deepening their bilateral partnership, highlighted by the Green Digital Shipping Corridor agreement signed on March 25, 2025, to drive decarbonization and technological advancement in the maritime sector.

-

03/25/2025

Indian Steel and Aluminum Exports Face Uncertainty as US Tariffs Loom

India Briefing -

03/24/2025

India Adopts Proof of Origin in New Customs Compliance Framework

India Briefing -

03/21/2025

India-Canada Eye Strategic Partnership Amid Shifting Global Trade Dynamics

India Briefing -

03/20/2025

India–New Zealand Deepen Bilateral Ties, Set 60-Day Deadline for FTA Finalization

India Briefing -

03/12/2025

India Prepares Enhanced Tariff Reduction Proposal for US Trade Deal

India Briefing

Tax & Accounting

Corporate Taxation and Compliance Regime in India

04/14/2025In this edition of India Briefing Magazine, we explore India's latest corporate tax framework, which offers a comprehensive set of provisions that cater to diverse business structures, industry sectors, and operational models.

Claiming Foreign Tax Credit in India: Step-by-Step Guide to Form 67 Compliance

04/02/2025Foreign Tax Credit (FTC) can be claimed in India through Form 67. We provide you with details on eligibility, filing steps, and best practices to ensure compliance and maximize tax benefits.

India Revises Tax Audit Reporting with Form 3CD Changes Effective April 1, 2025

03/31/2025India has implemented revisions to Form 3CD, effective from April 1, 2025, requiring businesses and tax professionals to adhere to enhanced disclosure requirements under the updated tax audit regulations.

India's GST Compliance Changes from April 1, 2025: All You Need to Know

03/31/2025From April 1, 2025, India’s GST compliance will see major changes, including mandatory multi-factor authentication (MFA), stricter e-way bill (EWB) rules, mandatory Input Service Distributor (ISD) registration, and a lower e-invoicing threshold.

Mandatory ISD Registration Under GST Begins April 1, 2025: What Businesses Need to Know

03/27/2025From April 1, 2025, India will require mandatory ISD registration under GST to ensure accurate tax credit distribution and compliance. India Briefing explores the key changes and their potential impact on businesses in the country.

India's Tax Authority Invites Stakeholder Input on New Income Tax Bill, 2025

03/19/2025India's CBDT is inviting public feedback on the proposed Income Tax Bill, 2025, aimed at modernizing the country's tax system. A dedicated feedback link is now live on the Income Tax Department’s e-filing portal since March 8, 2025.

-

03/13/2025

Guide to Advance Tax Filing in India for FY 2024-25

India Briefing -

02/26/2025

Understanding the New Tax Residency Rules for NRIs

India Briefing -

02/13/2025

India's New Income Tax Bill 2025: An Overview

India Briefing -

02/05/2025

Personal Income Tax Changes in India Under the New Regime for FY 2025-26

India Briefing -

02/03/2025

India Briefing

Legal & Regulatory

SEBI Amends ICDR Regulations for Capital Raising and Disclosure Norms

04/09/2025SEBI’s 2025 amendments to ICDR Regulations overhaul norms for public offers, rights issues, and SAR disclosures. Learn what’s changed and how it impacts issuers and investors.

MCA Proposes Expansion of Fast-Track Merger Rules in India

04/08/2025To streamline corporate restructuring and boost ease of doing business in India, the Ministry of Corporate Affairs has proposed expanding fast-track mergers under Section 233 of the Companies Act, 2013.

Mandatory ISD Registration Under GST Begins April 1, 2025: What Businesses Need to Know

03/27/2025From April 1, 2025, India will require mandatory ISD registration under GST to ensure accurate tax credit distribution and compliance. India Briefing explores the key changes and their potential impact on businesses in the country.

India Adopts Proof of Origin in New Customs Compliance Framework

03/24/2025India’s new CAROTAR Rules require Proof of Origin instead of traditional certificates. Understand the compliance impact, documentation updates, and industry concerns.

India’s Immigration and Foreigners Bill, 2025: What Businesses Need to Know

03/18/2025India's Immigration and Foreigners Bill 2025 introduces major immigration reforms to boost ease of doing business, attract foreign investment, streamline visa processes, and enhance digital immigration management systems.

India’s Digital Competition Bill Advances with Industry Insights

03/17/2025India is assessing stakeholder feedback on its Draft Digital Competition Bill, underscoring its aim to establish balanced legislation and equitable digital market practices.

-

03/14/2025

India’s Passport Rules 2025: Key Changes You Need to Know

India Briefing -

03/05/2025

Biometric Authentication for GST in India: Everything You Need to Know

India Briefing -

02/26/2025

Understanding the New Tax Residency Rules for NRIs

India Briefing -

02/20/2025

BRSR Reporting in India: Key Changes to ESG Disclosures Introduced by SEBI

India Briefing -

02/18/2025

Competition Commission of India Introduces Draft Regulations on Predatory Pricing

India Briefing

Industries

India’s Semiconductor Market Value to Reach US$108 Billion by 2030: Report

04/16/2025India's semiconductor market is set to double to US$108B by 2030, according to the latest industry report. The growth is likely to be driven by domestic demand, design expertise, and strategic policies fostering localization and global partnerships.

India Manufacturing Tracker 2025

04/14/2025Introducing the India Manufacturing Tracker 2025 by India Briefing—your go-to source for real-time updates on the country's industrial production, emerging trends, and key sector insights.

Apple, Foxconn Boost iPhone Output in India as US Tariffs Reshape Supply Chains

04/07/2025Apple's iPhone production in India is being expanded to 25–30 million units by 2025, driven by Foxconn’s Bengaluru facility and a strategic shift from China amid US tariffs.

India Announces PLI Scheme for Passive Electronics with INR 229.19 Billion Budget

04/01/2025On March 28, 2025, India launched a INR 229.19 billion (US$2.68 billion) Production Linked Incentive (PLI) scheme to boost the domestic manufacturing of passive electronics, with a six-year implementation plan.

India's Semiconductor Sector: Tracking Government Support and Investment Trends

03/20/2025We track India's efforts to facilitate foreign investment into its indigenous semiconductor industry (developing fabs. chip design, ATMP).

Quick Commerce Leads India’s US$13.7 Billion Venture Capital Resurgence in 2024

03/11/2025India's venture capital market rebounded in 2024, hitting US$13.7 billion in funding, led by rapid growth in the quick commerce sector.

-

03/07/2025

India's Service Sector Outlook for FY 2025-26: Growth Drivers and Economic Impact

India Briefing -

03/05/2025

India Hikes PLI Budget for FY2025-26 to Boost Growth in Key Sectors

India Briefing -

03/04/2025

Emerging Role of Tier 2 and 3 Cities in India’s Warehousing and Logistics Growth

India Briefing -

03/03/2025

India’s Growing Power Sector in 2025: Investor Outlook

India Briefing -

02/26/2025

Gift City, Mumbai, and Delhi Climb Global Financial Centre Index Rankings

India Briefing

HR & Payroll

A Guide to Minimum Wage in India in 2025

03/17/2025We answer some frequently asked questions foreign hiring managers may have regarding the minimum wage in India. In January 2025, Meghalaya became the latest region to revise the minimum wages of all categories of workers in the state.

India’s Tech Workforce Shifts as GCCs Outpace Traditional IT Firms

03/10/2025India’s tech sector is witnessing a major workforce hiring shift in 2025, led by the rise of GCCs, changing business models, and AI adoption.

India Offers Tax Relief for Foreign Tech Experts to Boost Electronics Manufacturing Sector

02/11/2025India has introduced a tax relief measure for highly skilled foreign engineers, tech experts, and support teams. This new policy will allow companies to bring in specialists, including those from China, for short-term assignments.

Employee Retention Strategy in India: Corporate Sector Explores New Retirement Options in 2025

02/07/2025We discuss how domestic and foreign companies operating in India can strengthen their employee retention by tapping into diverse retirement plans that provide the workforce with long-term financial security and optimize tax efficiency.

India’s POSH Act: Annual Reporting Obligations and Proposed Amendments

02/04/2025India's Prevention of Sexual Harassment (POSH) Act and its corresponding Rules require a mandatory annual report to be submitted by the employer to the District Officer and is also part of reporting obligations to the Registrar of Companies.

India’s Union Budget 2025-26 Highlights: Reforms to Drive Economic Growth, Manufacturing, Consumption

02/03/2025India's Union Budget for 2025-26 introduces key revisions to taxation policies, along with provisions targeting focus industries and MSMEs. The overarching goal is to further simplify business regulations, stimulate middle-class consumption, and promote innovation.

-

01/08/2025

An Introduction to Doing Business in India 2025 - New Publication Out Now

India Briefing -

12/10/2024

Tax Advisory for Remote Workers in India: Optimizing Savings

India Briefing -

12/03/2024

India Labor Compliance: How the Shram Suvidha Portal Works

India Briefing -

12/03/2024

India Wants Gig Workers to Register on e-Shram Portal, Come Under Social Security Net

India Briefing -

11/28/2024

Key Considerations for Expatriates in India: Jobs, Location Costs, and Tax

India Briefing

Our firm Dezan Shira & Associates provides legal, tax and operational advisory across Asia.

Our firm Dezan Shira & Associates provides legal, tax and operational advisory across Asia.