Economy & Trade

Vietnam’s New E-Commerce Tax Decree: What Digital Platforms Need to Know

04/16/2025Vietnam’s e-commerce tax is in force, requiring digital platforms to withhold and report taxes on seller transactions.

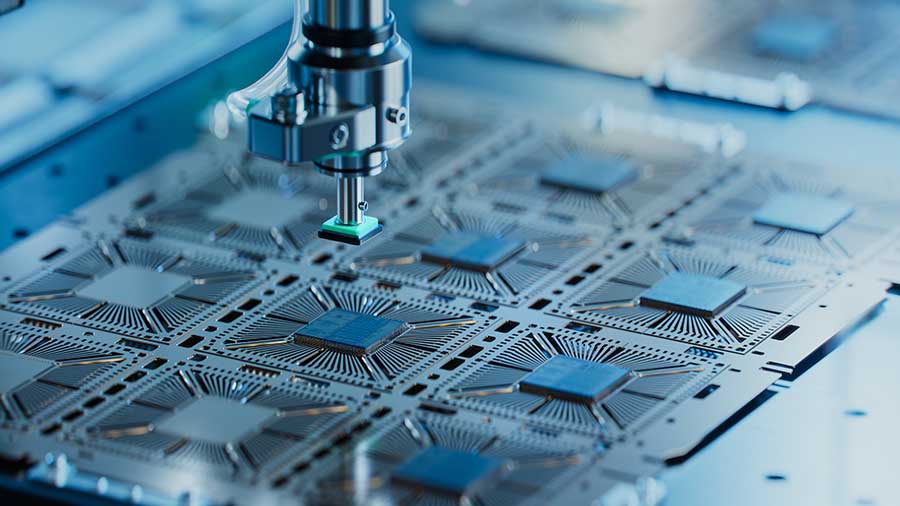

How U.S. Tariff Exemptions on Electronics Could Reshape Southeast Asia’s Manufacturing Landscape

04/14/2025The U.S. tariff exemptions cover electronics imports from ASEAN, including semiconductors and key components.

Brunei's Economic Diversification Efforts: Moving Beyond Oil and Gas

04/10/2025Explore Brunei's economic diversification efforts beyond oil and gas, key growth sectors, and investment opportunities under Wawasan 2035.

Navigating US Tariffs: A Strategic Outlook for Indonesia

04/10/2025This article explores potential business and policy strategies Indonesia could consider in response to new U.S. tariffs.

ASEAN's Response to US Tariffs: Toward a Unified Regional Strategy

04/10/2025ASEAN countries respond individually to U.S. tariffs while exploring options for a possible coordinated regional strategy.

Cambodia's Special Economic Zones: A Guide for Foreign Investors

04/08/2025Foreign investors can benefit from Cambodia’s SEZs through tax incentives, key industry access, and streamlined procedures.

-

03/31/2025

Singapore's Role as ASEAN's Financial Hub: Can it Maintain its Lead?

ASEAN Briefing -

03/18/2025

Vietnam and Singapore Upgrade Ties to a Comprehensive Strategic Partnership

ASEAN Briefing -

03/17/2025

US Tariffs on Canada: A New Opportunity for Wheat Exports to Indonesia?

ASEAN Briefing -

03/14/2025

How Singapore is Enhancing Philanthropy Through Policy Reforms

ASEAN Briefing -

03/10/2025

Indonesia Officially Launches New Sovereign Wealth Fund Danantara

ASEAN Briefing

Tax & Accounting

Investing in Malaysia - Key Sectors and Opportunities for Foreign Investors

04/03/2025The latest issue of ASEAN Briefing Magazine, titled “Investing in Malaysia - Key Sectors and Opportunities for Foreign Investors”, is out now and available to subscribers as a complimentary download in the Asia Briefing Publication Store.

Malaysia’s Global Minimum Tax: Key Implications for Multinationals

04/03/2025Malaysia’s Global Minimum Tax framework affects MNCs with new compliance rules, tax adjustments, and ASEAN-wide implementation trends.

Transfer Pricing in the Philippines: A Guide for Foreign Investors

03/21/2025Foreign investors in the Philippines must comply with transfer pricing rules set by the BIR to avoid penalties and audits.

Filing Personal Income Tax in the Philippines: A Guide for Foreigners

03/20/2025Learn how foreigners can file personal income tax in the Philippines, understand tax residency, rates, deductions, and filing options.

Travel Tax in the Philippines: A Guide for Foreigners

03/18/2025Get an in-depth guide on Philippine travel tax for foreigners, including rates, exemptions, payment methods, refunds, and key regulations.

Transfer Pricing in Thailand: A Guide for Foreign Investors

03/18/2025Learn about Thailand's transfer pricing rules, documentation requirements, and compliance strategies to avoid penalties and risks.

-

03/13/2025

Filing Corporate Income Tax in the Philippines: A Guide for Foreign Businesses

ASEAN Briefing -

03/07/2025

Vietnam's VAT on Low-Value Imported Goods: One Month into Implementation

ASEAN Briefing -

03/04/2025

What Foreigners Need to Know About Taxable Income in Malaysia

ASEAN Briefing -

02/26/2025

Sales Tax in Malaysia: A Guide for Foreign Investors

ASEAN Briefing -

02/20/2025

A Guide to Taxation in the Philippines - Updates for 2025

ASEAN Briefing

Legal & Regulatory

Thailand's Land Ownership Rules for Foreigners: A Comprehensive Guide

04/08/2025Explore Thailand's land ownership laws for foreigners, including leaseholds, condos, BOI incentives, and key restrictions.

How to Set Up a Representative Office in the Philippines: A Guide for Foreign Investors

04/04/2025Learn how to set up a Representative Office in the Philippines, including registration steps, legal requirements, and compliance guidelines.

Investing in Malaysia - Key Sectors and Opportunities for Foreign Investors

04/03/2025The latest issue of ASEAN Briefing Magazine, titled “Investing in Malaysia - Key Sectors and Opportunities for Foreign Investors”, is out now and available to subscribers as a complimentary download in the Asia Briefing Publication Store.

How to Set Up a Representative Office in Thailand – A Guide for Foreign Investors

04/02/2025A representative office in Thailand allows foreign businesses to establish a non-commercial presence while complying with legal regulations.

Dispute Resolution in Malaysia: Key Mechanisms & Legal Insights

03/26/2025Explore Malaysia’s dispute resolution framework and learn how to navigate disputes efficiently in Malaysia’s business environment.

Vietnam Expands Foreign Ownership in Banking: Key Opportunities for Investors

03/24/2025Vietnam is expanding foreign ownership in its banking sector, creating new investment opportunities for global financial institutions.

-

03/19/2025

Business Registration Certificates in Vietnam: A Guide for Foreign Investors

ASEAN Briefing -

03/11/2025

Registering a Trademark in Thailand: A Guide for Foreign Investors

ASEAN Briefing -

03/04/2025

How to Setup a Non-Profit Organization in Singapore: A Guide for Foreign Investors

ASEAN Briefing -

02/12/2025

Understanding Variable Capital Companies in Singapore

ASEAN Briefing -

02/12/2025

How Foreign Investors Can Establish a Restaurant in Malaysia

ASEAN Briefing

Industries

Investment Opportunities in the Lao Agriculture Sector

04/16/2025Laos offers strong investment prospects in agriculture, with 2024 data showing high growth in rice, coffee, and maize exports.

Indonesia's Nickel Downstreaming Policy: Opportunities and Challenges for Investors

04/09/2025Explore Indonesia’s nickel policy, investment opportunities, and regulatory challenges shaping the future of global supply chains.

Investing in Malaysia - Key Sectors and Opportunities for Foreign Investors

04/03/2025The latest issue of ASEAN Briefing Magazine, titled “Investing in Malaysia - Key Sectors and Opportunities for Foreign Investors”, is out now and available to subscribers as a complimentary download in the Asia Briefing Publication Store.

Thailand's Automotive Industry: A Guide for Foreign Investors

03/27/2025Thailand's automotive industry offers strong investment potential with government incentives, EV expansion, and a robust supply chain.

Laos' Hydropower Sector: Opportunities for Foreign Investors

03/26/2025Laos aims to become a regional leader in hydropower, attracting foreign investment through large-scale projects and energy exports.

Singapore’s Medical Tourism Industry: Growth, Opportunities, and Future Trends

03/26/2025Singapore’s medical tourism industry offers world-class healthcare, cutting-edge technology, and growing investment opportunities.

-

03/24/2025

Indonesia Requires Exporters to Retain Earnings Onshore: Key Insights for Investors

ASEAN Briefing -

03/21/2025

Investment Opportunities in Vietnam's Agriculture Sector

ASEAN Briefing -

03/17/2025

Malaysia’s Semiconductor Growth: Can it Move up the Value Chain?

ASEAN Briefing -

03/17/2025

Singapore's Maritime Industry: A Guide for Foreign Businesses

ASEAN Briefing -

03/13/2025

Opportunities for Foreign Investors in Cambodia's Construction Industry

ASEAN Briefing

HR & Payroll

Indonesia Updates Job Loss Program: What Employers Need to Know

04/18/2025Discover how Indonesia’s revised job loss program affects employer contributions, compliance duties, and workforce planning.

Thailand Simplifies Work Permit Process for Foreign Workers

04/16/2025Thailand cuts red tape in work permit rules to attract foreign talent and support labor-intensive industries.

Laos' Labor Market Challenges and Opportunities: What Investors Should Consider

04/01/2025Laos offers cost-effective labor and investment potential but faces skills shortages, migration, and regulatory challenges for businesses.

Understanding Malaysia's Foreign Worker Policies: A Guide for Foreign Investors

03/26/2025Learn about Malaysia's foreign worker policies, hiring process, visa types, and compliance rules to ensure smooth business operations.

Religious Holiday Allowances in Indonesia: Obligations for Businesses

03/21/2025With the upcoming Eid-al Fitr holiday in Indonesia, businesses must pay the religious holiday allowance, also known as Tunjangan Hari Raya (THR).

Thailand Eases Requirements for Long-Term Resident Visas

03/20/2025Thailand has lowered the income and work experience requirements for long-term resident visas, making it easier for foreign professionals to qualify.

-

03/19/2025

Business Visas in Vietnam: A Guide for Foreign Investors

ASEAN Briefing -

03/12/2025

Hiring in Indonesia Without a Local Entity: Challenges and Solutions

ASEAN Briefing -

03/11/2025

Breaking Down Singapore’s Work Permit Changes: What’s New for 2025?

ASEAN Briefing -

03/06/2025

A Guide to Work Permits in Malaysia

ASEAN Briefing -

03/05/2025

A Guide to Singapore’s Long-Term Visit Pass

ASEAN Briefing

Our firm Dezan Shira & Associates provides legal, tax and operational advisory across Asia.

Our firm Dezan Shira & Associates provides legal, tax and operational advisory across Asia.