By Tracie Sloop Frost

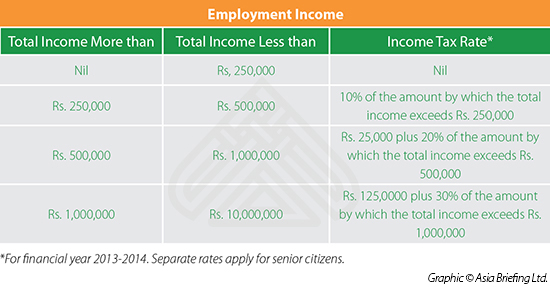

In India, an individual’s income is taxed at graduated rates, depending on his/her duration of stay in India and income level. Non-employment income is taxed at a variable rate according to income type. In this article, we outline the rates and calculation methods for both income sources, and summarize common deductions and inclusions in income for expatriates working in India.

RELATED: Pre-Investment Services from Dezan Shira & Associates

RELATED: Pre-Investment Services from Dezan Shira & Associates

The Indian tax year runs from April 1 to March 31. Total income tax is calculated in accordance with the tax rates and rules that stand o,n the first day of April of the assessment year. Income earned in a year is taxable in the next year. The year in which income is earned is known as the previous year, while the next year in which income is taxable is known as the assessment year (for more information please see our earlier article on tax deadlines).

Employment income includes all amounts, either in cash or in kind, that arise from an individual’s employment. Wages, pensions, bonuses, commissions, perquisites in lieu of salary, reimbursement for personal expenses, securities or sweat equity shares, contributions to superannuation funds, etc. are all includable in employment income.

In addition, India provides that certain perquisites and allowances must also be included in employment income. Perquisites and allowances are taxed differently under Indian law. Limited deductions from income also exist.

Perquisites

A perquisite is any benefit received by the employee that is in addition to salary. Perquisites increase taxable income. In general, the taxable value of the perquisites to the employee is their cost to the employer. However, India has given specific rules for the valuation of the following perquisites provided by the employer:

- Residential accommodations

- Motor car

- Utilities

- Free or concessional educational facilities

- Free or concessional travel

- Sweeper, gardener, security, or domestic help

- Interest free loans

- Meals

- Gifts, vouchers, tokens

- Club memberships

RELATED: Tax Planning Services from Dezan Shira & Associates

RELATED: Tax Planning Services from Dezan Shira & Associates

Perquisites exempt from tax are provision of medical facilities and provision of mobile phones used by the employee for business purposes.

Allowances

An allowance is defined as a fixed quantity of money given regularly in addition to salary for employees to meet specific requirements. Allowances increase taxable income. Examples of common allowances for expatriates include:

- House rent allowance

- Travel allowance

- Children’s education allowance

Many allowances have a small exemption amount. For example, the children’s education allowance has an exemption for up to Rs. 100 per month for up to two children.

Other allowances are fully exempt as long as actual expenses are incurred by the employee. For example, reimbursement of expenses actually incurred in the performance of an individual’s employment are exempt. Many other exemptions exist for allowances, and taxpayers should consult with a chartered accountant in order to take full advantage of such exemptions.

Deductions

A deduction from income is available up to Rs. 150,000 for investments in life insurance, contributions to social security funds, and tuition and fees for the purpose of full-time education at a university, college or other educational institution.

Non-Employment Income

Non-employment income taxable in India includes long and short-term capital gains earned on the disposal of capital assets situated in India and royalties payable by an Indian concern. It should be noted that investments in shares by non-resident foreign nationals are governed by the Indian foreign direct investment policy. Long-term capital gains are taxed at a flat 20 percent. Short term capital gains are taxed at 15 percent if listed on a stock exchange in India. Royalties and interest earned from an Indian concern are taxable at 10 percent.

Other Taxes

India assesses a surcharge of 12 percent of the tax on taxpayers with income in excess of Rs. 10 million. There is also an education tax assessed at 3 percent of the tax. Foreign nationals are additionally required to contribute to the Indian social security scheme.

Double Taxation Avoidance Agreements

Most expatriates worry about “double taxation” – paying taxes to two different countries on the same income. A foreign taxpayer working in India may be able to reduce taxable income in their country of primary residence (and double taxation) under a double taxation avoidance agreement. For U.S. citizens this is done using Form 1116, Foreign Tax Credit.

Tax Planning

Opportunities for tax planning exist in how employers structure wages, perquisites, and allowances. In general, it is tax favorable to have expenses reimbursed rather than given as perquisites or included in wages. However, every situation is different, and foreign nationals should consult a chartered accountant to determine the best structuring of wages and benefits for their situation.

|

About Us Asia Briefing Ltd. is a subsidiary of Dezan Shira & Associates. Dezan Shira is a specialist foreign direct investment practice, providing corporate establishment, business advisory, tax advisory and compliance, accounting, payroll, due diligence and financial review services to multinationals investing in China, Hong Kong, India, Vietnam, Singapore and the rest of ASEAN. For further information, please email india@dezshira.com or visit www.dezshira.com. Stay up to date with the latest business and investment trends in Asia by subscribing to our complimentary update service featuring news, commentary and regulatory insight. |

![]()

Managing Your Accounting and Bookkeeping in India

In this issue of India Briefing Magazine, we spotlight three issues that financial management teams for India should monitor. Firstly, we examine the new Indian Accounting Standards (Ind-AS) system, which is expected to be a boon for foreign companies in India. We then highlight common filing dates for most companies with operations in India, and lastly examine procedures and regulations for remitting profits from India.

Tax, Accounting, and Audit in India 2014-2015

Tax, Accounting, and Audit in India 2014-2015

Tax, Accounting, and Audit in India 2014-2015 offers a comprehensive overview of the major taxes foreign investors are likely to encounter when establishing or operating a business in India. This concise, detailed, yet pragmatic guide is ideal for CFOs, compliance officers and heads of accounting who need to be able to navigate the complex tax and accounting landscape in India in order to effectively manage and strategically plan their India-based operations.

An Introduction to India’s Audit Process

An Introduction to India’s Audit Process

In this issue of India Briefing Magazine, we provide readers with an overview of India’s annual audit process and offer important tips for the smooth navigation of the country’s audit regulations and accounting standards. We begin by first explaining the two most common types of audit in India, statutory and internal audits, and then outline the standard steps and procedures an Indian auditor will follow in each.