This article is an excerpt from the May 2014 Issue of Asia Briefing Magazine, titled “E-Commerce Across Asia: Trends and Developments 2014.”

By Shawn Greene

Not since the introduction of the first mail order catalog in 1861 have business-to-consumer relations undergone as fundamental a change as they have in the past decade. Made possible by the rapid spread of internet access to more than 30 percent of the world’s population, the rise of e-commerce has forever revolutionized the way goods and services are bought, sold, researched, and marketed globally.

Not since the introduction of the first mail order catalog in 1861 have business-to-consumer relations undergone as fundamental a change as they have in the past decade. Made possible by the rapid spread of internet access to more than 30 percent of the world’s population, the rise of e-commerce has forever revolutionized the way goods and services are bought, sold, researched, and marketed globally.

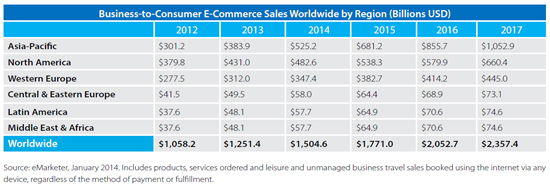

This year, for the first time since business-to-consumer (B2C) e-commerce sales broke the US$1 trillion mark in 2012, the Asia- Pacific region will become the largest regional e-commerce market in the world, with consumers there projected to outspend their North American counterparts by US$40 billion and account for more than 45 percent of all online buyers worldwide. Although growth in the Asia-Pacific e-commerce market is currently led by China, Indonesia, and India, several other developing economies across Southeast Asia are set to spearhead e-commerce growth in the near future as internet penetration in the region approaches 50 percent.

For foreign investors, understanding the increasingly significant role of business-to-business (B2B) and B2C e-commerce in emerging Asian markets is a critical prerequisite to formulating a competitive long-term investment strategy. Understanding the current state of e-commerce in Asia and its development potential requires a familiarity with macroeconomic trends and development indicators in addition to the country-specific rules and regulations that govern foreign investment in electronic retail.

Electronic commerce, commonly known as e-commerce, refers to commercial transactions conducted electronically over the internet. This traditionally encompasses the buying and selling of products or services through online retail, and in recent years has expanded to include “showrooming” where consumers look at and try on products in a physical retail store before purchasing the same item online at a discounted price. While the two most common types of e-commerce consist of B2B and B2C transactions, previously obscure channels such as consumer-to-business (C2B), consumer-to-consumer (C2C), and government-to-citizen (G2C) are becoming more prevalent.

According to eMarketer projections, global B2C e-commerce sales will grow by more than 20 percent this year to reach US$1.5 trillion, and surpass US$2.3 trillion by 2017. Forrester Research projections indicate this growth will be partly driven by five of the largest online retail markets in the Asia-Pacific region – China, Japan, South Korea, India, and Australia – which will see e-commerce sales rise from US$398 billion in 2013 to US$858 billion in 2018 at a compound annual growth rate of more than 16 percent.

At this rate, by 2017 these five markets will overtake the United States, Canada, and Western Europe combined, with China accounting for more than six of every 10 dollars spent on e-commerce in the Asia- Pacific region this year, and three-quarters of all regional spending by 2017. While China’s B2C e-commerce market is growing the most rapidly by far, at an astounding 93.7 percent in 2012 and 78.5 percent in 2013, it is easy to overlook other Asia-Pacific markets set to make a big splash in e-retail over the next decade.

Regional E-Commerce Trends

Identifying markets in the Asia-Pacific region with the greatest potential for investment in online retail requires an analysis of various economic and development indicators alongside the country-specific rules and regulations that govern foreign investment in e-commerce.

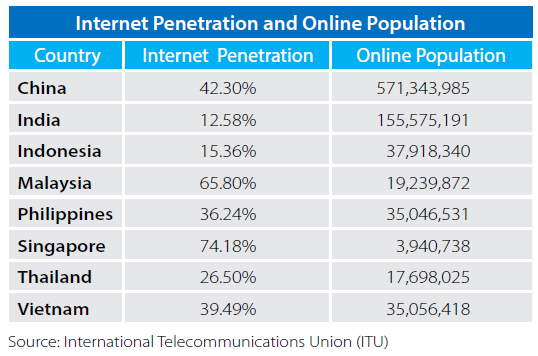

Because the three most fundamental elements of any B2C e-commerce transaction include a business, a consumer, and some form of internet connection through which a product or service can be purchased, analyzing internet penetration rates alongside consumer demographics is a good place to begin mapping growth potential.

Internet and Mobile Broadband Penetration

Internet penetration, or the percentage of a population with internet or mobile broadband access, varies considerably across the Asia- Pacific region and has increased rapidly over the past decade.

According to the International Telecommunications Union (ITU), more than 31 percent of individuals and 32 percent of households in the Asia-Pacific region had internet access in 2013. While these penetration rates may appear low in comparison to Europe (77 and 75 percent) and the Americas (60 and 61 percent), the Asia-Pacific region’s sizeable population means the total number of individuals actively using the internet last year—1.27 billion people—exceeded the Americas and Europe combined (1.05 billion) by a significant margin. This number is especially impressive when viewed in the context of penetration growth—the region recorded 344 million internet users in 2005, and more than 999 million just six years later.

Skyrocketing internet penetration rates across the region are being partly driven by an increase in mobile broadband subscriptions. When comparing modes of internet access, only around eight percent of the regional population actively accessed the internet in 2013 through a fixed (wired) broadband connection, while more than 22 percent utilized mobile broadband.

With around 900 million mobile broadband subscribers at the beginning of 2014, the region’s compound annual growth rate in mobile broadband subscriptions far exceeded that for fixed broadband between 2010 and 2013—45 percent for mobile in comparison to only 14.5 percent for fixed broadband. Partly as a result of this disparity, Asia-Pacific consumers are significantly more likely to purchase goods and services through mobile devices (37 percent) than the global average (26 percent).

In terms of country-specific internet growth, the Philippines is currently estimated to have the fastest growing internet population in the world, with recent statistics estimating 530 percent growth over the past five years. Close behind the Philippines in global rankings are Indonesia with 430 percent growth over the same period, India in fourth place at 230 percent, and Vietnam in seventh with 82 percent growth.

Consumer Spending

As internet penetration rates soar across the region, understanding consumer demographics and spending habits is quickly becoming the key to identifying strategic growth markets. While reliable statistics on online shoppers in the Asia-Pacific region are still limited, analysis suggests they closely resemble their European and North American counterparts in tending to be middle class and between the ages of 25 and 64.

According to the Organization for Economic Cooperation and Development (OECD), middle class consumers in the Asia-Pacific region accounted for 28 percent of the global middle class in 2009, and are projected to account for more than 50 percent by 2020. Spending by these middle class consumers accounted for 23 percent of total global spending in 2009, and is predicted to reach more than 40 percent by 2020. In comparison, North America and Europe accounted for 64 percent of the global middle class and 54 percent of spending in 2009—these numbers are projected to fall to 46 and 32 percent, respectively, by 2020.

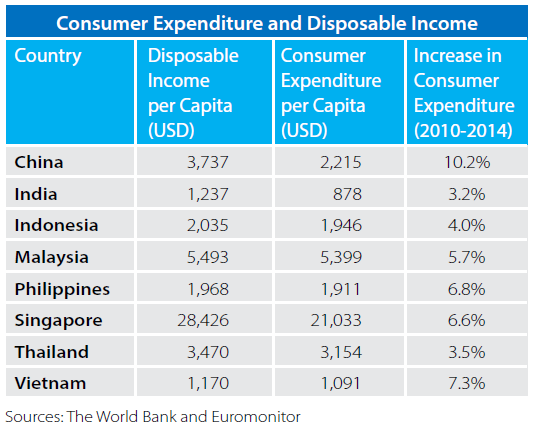

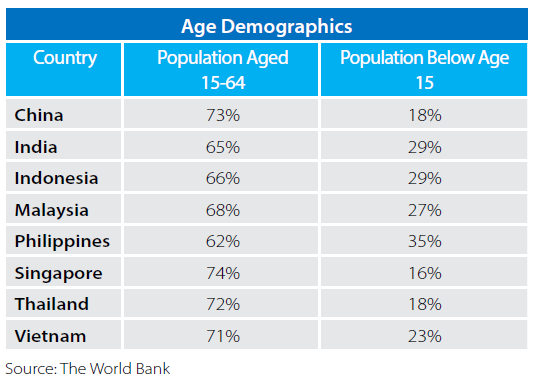

While steadily rising consumer expenditures and disposable income levels across the region suggest that these middle class consumers are at least partially responsible for the recent explosion in e-retail growth, they do little to enable country-specific growth predictions. To accomplish this, economists are drawing connections between a country’s age structure and economic growth, hoping to discover and predict changes in respective middle-class size and disposable income levels.

Shifting age demographics impact opportunities for e-commerce growth in two distinct ways. The first relates to what economists refer to as demographic dividends and deficits. Significant economic growth potential (a dividend) occurs when a country’s dependency ratio is low, or when very young and old members of a population (dependent groups) are significantly outnumbered by working-age adults.

When a dividend occurs, working-age adults supply the labor and savings needed to support dependent groups while attracting the investment and industry needed to drive overall economic growth. The Philippines, India, Malaysia, and Vietnam are among several countries in the region set to reap the benefits of a demographic dividend in the next five to ten years, and are projected to host an increasing number of middle class consumers as a result. Countries like China, on the other hand, have already reaped the benefits of a demographic dividend and currently host a large middle class.

The second key impact concerns an increase in the target demographic for B2C e-commerce sales. With individuals in the 25-64 age range spending the most online each year, countries with a large population in this age range, such as China and Singapore, are now experiencing booming e-commerce markets. Countries with a sizeable youth population and a slightly smaller population in the working-age range (e.g. Indonesia, India, and the Philippines) are thus well-placed to see an increase in online retail in the near future.

FDI Rules and Regulations in E-Commerce

In a region rife with opportunity for growth in online retail and other forms of e-commerce, the greatest impediments to expansion remain rules and regulations that limit or restrict foreign investment in e-commerce. As discussed at length in the pages that follow, some of the most promising markets for foreign investment in e-commerce remain off-limits to foreign companies, such as in India, or else feature significant barriers to market entry such as the requirement that companies establish a physical retail shop before establishing an online store, as in China. Consideration of these limitations and barriers is critical when evaluating opportunities for investment in e-commerce worldwide.

This article is an excerpt from the May 2014 edition of Asia Briefing Magazine, titled “E-Commerce Across Asia: Trends and Developments 2014.” In this issue, we provide a comprehensive overview of e-commerce trends across the Asia-Pacific region with a focus on developing markets in Southeast Asia. In addition to analyzing macro-level economic and development indicators that signal the potential for region-wide growth, we explore several rapidly growing markets in-depth while highlighting opportunities for investment in each.

This article is an excerpt from the May 2014 edition of Asia Briefing Magazine, titled “E-Commerce Across Asia: Trends and Developments 2014.” In this issue, we provide a comprehensive overview of e-commerce trends across the Asia-Pacific region with a focus on developing markets in Southeast Asia. In addition to analyzing macro-level economic and development indicators that signal the potential for region-wide growth, we explore several rapidly growing markets in-depth while highlighting opportunities for investment in each.

Asia Briefing Ltd. is a subsidiary of Dezan Shira & Associates. Dezan Shira is a specialist foreign direct investment practice, providing corporate establishment, business advisory, tax advisory and compliance, accounting, payroll, due diligence and financial review services to multinationals investing in China, Hong Kong, India, Vietnam, Singapore and the rest of ASEAN. For further information, please email asia@dezshira.com or visit www.dezshira.com.

Stay up to date with the latest business and investment trends in Asia by subscribing to our complimentary update service featuring news, commentary and regulatory insight.

Related Reading

China Further Promotes E-Commerce Development

Shanghai FTZ Launches Cross-Border E-Commerce Platform

China Offers Preferential Tax Treatment to Exports by E-Commerce Retail Enterprises

Vietnam Online – Understanding Vietnam’s E-commerce Market

DIPP to Push for Higher FDI Cap in E-Commerce