By Nathan Barlow

Jul. 11 – A report released last month by the United Nations Conference on Trade and Development (UNCTAD) highlighted the Philippines lagging FDI, receiving only US$2.8 billion in 2012.

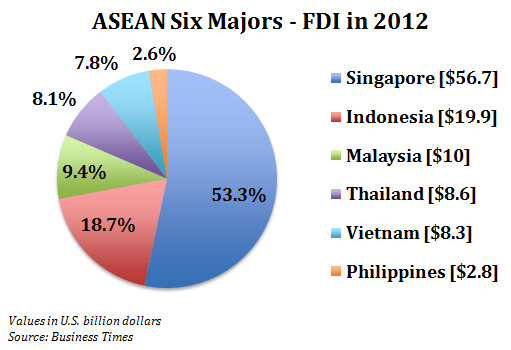

Of the ASEAN six majors (which refers to the six largest economies in ASEAN: Indonesia, Thailand, Malaysia, Singapore, the Philippines and Vietnam) Philippines received just 2.6 percent of total FDI to these countries.

Infrastructure spending on the rise

In response to criticisms that the Philippines’ poor infrastructure has been deterring greater FDI flows, the Filipino government started to dramatically increase infrastructure investment – particularly on public infrastructure. As a result, the Department of Budget and Management reported that the country had spent a total of 75.2 billion Filipino pesos on infrastructure investments from January to April of this year alone, which is nearly 45 percent more compared to the same period in 2012.

Furthermore, various financial institutions have encouraged the Philippines to boost its infrastructure spending even more. The World Bank stated that the Filipino government should raise its spending on public infrastructure from the current 3 percent of GDP to 5 percent by 2016. In addition, the Asian Development Bank advocated an even greater increase in infrastructure spending of up to 7 or 8 percent of GDP by 2016.

Infrastructure development is increasingly crucial for the Philippines as FDI meets new challenges in the region. Not only is Vietnam experiencing high inflation and rising wages, but Indonesia’s labor unions have also begun demanding higher wages, with Thailand experiencing problematic water shortages.

Furthermore, China is becoming more expensive for businesses and a less desirable location for FDI. Last year, FDI into China decreased from US$124 billion to US$121 billion, a trend which may indicate a plateau in investment flows to the region.

“These dynamics automatically [improve] the position of the Philippines as a possible destination of investment [in the region], becoming more attractive, supported by the government’s macroeconomic management… The question is, if we can, [if] we want to seize the opportunity to attract more,” said Norio Usui, the Philippines Country Economist for the Asian Development Bank.

Currently lagging, yet rapidly rising

Despite the Philippines low figures compared to other ASEAN countries, FDI in the country is growing rapidly.

Citibank cited that the Philippines is beginning to catch up with its neighbors in attracting FDI, at a rate faster than any other ASEAN country. FDI into the Philippines remarkably grew by 185 percent, from $981 million in 2011 to $2.8 billion to 2012.

“The Philippines remains the regional FDI laggard but interestingly saw the sharpest year-on-year rise in ASEAN… Our projections suggest that infrastructure can contribute as much as 20 percent of the total investment rate in the Philippines till 2020,” said a report from Citibank.

The Filipino government’s renewed investment in infrastructure to attract FDI is a positive sign for future investors in the country. As FDI is drawn away from China and towards ASEAN, increased government expenditure and improved infrastructure will foster greater FDI flows into the Philippines.

You can stay up to date with the latest business and investment trends across Asia by subscribing to Asia Briefing’s complimentary update service featuring news, commentary, guides, and multimedia resources.

Related Reading

The Philippines Sees Economy Expand By 6.6% in 2012

Salt-Tolerant Rice Developed in the Philippines