The Following is an excerpt from Vietnam Briefing’s November edition, entitled “Navigating the Vietnam Supply Chain“, which provides valuable insight into the emergence of Vietnam as a destination for China plus on manufacturing. For more information find the whole article here on the Asia Briefing bookstore

Recently signed and pending implementation by individual member states, the TPP is one of the most anticipated trade developments in recent years. For Vietnam’s exporters, the agreement is a watershed moment which will see over 18,000 total tariff reductions extending to key industries such as garments, machinery, and electronics.

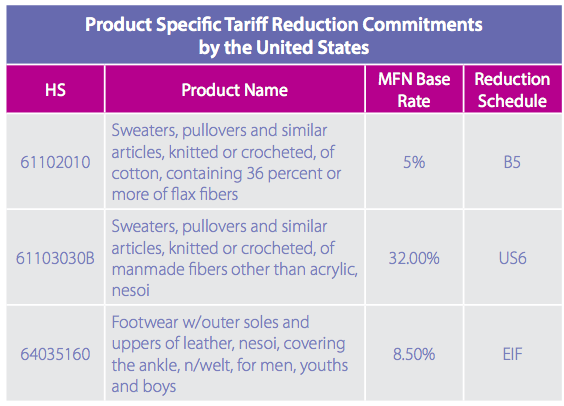

Understanding TPP’s Tariff Reductions

To leverage TPP tariff reductions, it is important to consider the various methods by which individual tariffs are reduced in member states party to the agreement. It should be immediately noted that, unlike some multilateral trade agreements, tariff reductions have been negotiated in a bilateral manner within the TPP package – resulting in specific and individual commitments by each state to every other state within the TPP. For example, the reduction of a Canadian tariff against a good from Australia does not guarantee Canadian reductions for Vietnamese Producers of similar goods.

While individual commitments may vary, the rage of options available to most countries are constrained and enjoy a level of uniformity throughout TPP. To illustrate this, the remaining paragraphs will explore the Tariff Reduction Schedule that the US has agreed to with regards to Vietnam.

RELATED: Business Model Comparison Services from Dezan Shira & Associates

RELATED: Business Model Comparison Services from Dezan Shira & Associates

US Reduction Schedules Under TPP

All US tariffs will be reduced on Vietnamese exports under one of the following reduction methods:

- EIF: Effective immediately from the date of implementation.

- B3-B20: Brought to zero in the number of yearly installments specified. B5, highlighted above, brings existing tariffs levied on HS 61102010 to zero over the course of five yearly reductions.

- US1-US25: Results in an initial tariff reduction (ranging from the base rate to upwards of 55 percent) followed by further reduction over a specified time period. US6 reduces tariffs on 61103030B by an initial 35 percent of the US MFN base rate upon entry into force of TPP followed by a complete removal of tariffs effective January 1 of year 11 of the TPP’s existence.

Each good within the TPP is subject to its own reduction schedule, allowing producers to locate their exports down to HS-8 digit specification. The rate at which a good will be dutied is dependent on a combination of preexisting duties levied prior to TPP, and the commitments that importing governments has made as part of the TPP.

![]()

Investing in Vietnam: Corporate Entities, Governance and VAT

In this issue of Vietnam Briefing Magazine, we provide readers with an understanding of the impact of Vietnam’s new Laws on Enterprises and Investment. We begin by discussing the various forms of corporate entities which foreign investors may establish in Vietnam. We then explain the corporate governance framework under the new Law on Enterprises, before showing you how Vietnam’s VAT invoice system works in practice.

In this issue of Vietnam Briefing Magazine, we provide readers with an understanding of the impact of Vietnam’s new Laws on Enterprises and Investment. We begin by discussing the various forms of corporate entities which foreign investors may establish in Vietnam. We then explain the corporate governance framework under the new Law on Enterprises, before showing you how Vietnam’s VAT invoice system works in practice.

E-Commerce in Vietnam: Trends, Tax Policies & Regulatory Framework

In this issue of Vietnam Briefing Magazine, we provide readers with a complete understanding of Vietnam’s e-commerce industry. We begin by highlighting existing trends in the market, paying special attention to scope for foreign investment. We look at means for online sellers to receive payment in Vietnam, examine the industry’s tax and regulatory framework, and discuss how a foreign retailer can actually establish an online company in Vietnam.

Tax, Accounting, and Audit in Vietnam 2014-2015

Tax, Accounting, and Audit in Vietnam 2014-2015

The first edition of Tax, Accounting, and Audit in Vietnam, published in 2014, offers a comprehensive overview of the major taxes foreign investors are likely to encounter when establishing or operating a business in Vietnam, as well as other tax-relevant obligations. This concise, detailed, yet pragmatic guide is ideal for CFOs, compliance officers and heads of accounting who need to be able to navigate the complex tax and accounting landscape in Vietnam.