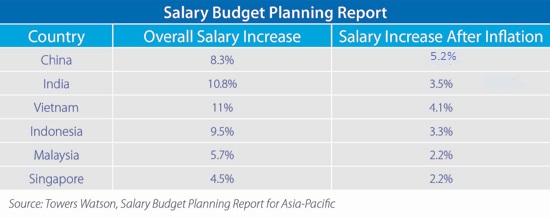

SHANGHAI – Salaries across the Asia-Pacific are due to increase on average by seven percent next year, according to a Salary Budget Planning Report released yesterday. The predictions, conducted by professional services firm Towers Watson, have provided a projected overall salary increase for twenty key nations in the region.

The report states that Pakistan, Bangladesh and Vietnam will see the steepest hikes, each at over 11 percent, whilst India follows close behind with an increase of 10.8 percent. However, the report also emphasizes that due to a rise in inflation in Asia, salary increases in ‘real terms’ will be entirely different.

Once inflation is taken into account, it shows that China will lead the way in wage increases in 2015, with a rise of 5.2 percent. Pakistan (4.5 percent), Bangladesh (4.3 percent), Vietnam (4.1 percent) and Sri Lanka (3.8 percent) then make up the four other nations in the top five of salary raises in 2015, with India ranking sixth with a corresponding real increase of 3.5 percent.

RELATED: Asia-Pacific Expat Salary Survey

The results are in keeping with recent salary trends in the Asia-Pacific, especially with regards to the region’s two biggest superpowers – India and China. Salary increases in India for 2014 were also forecasted to increase by a similar amount – 10 percent – but inflation ensured that the raise in real terms was far less. Indeed, in reality, the increase barely affected overall wages in the country.

Wages in China, meanwhile, seem to now be irrevocably on the rise. Where once its salary rate was notably low, China has been experiencing a steady increase in wages over the past several years, and the findings show that that trend is set to continue for the foreseeable future.

The report may therefore provide a glimpse of how investor trends may develop in the region next year, especially for the sourcing industry. Whilst China has firmly established itself as one of the most popular sourcing destinations in Asia, fears have abounded that increased salaries may cause businesses to jump ship to some of its comparatively cheaper neighbors. On the back of Towers Watson’s findings, it may be that the likes of India, Malaysia and Indonesia will capitalize on China’s higher wages, and become increasingly attractive sourcing alternatives to the region’s biggest power.

RELATED: Average Indian Salary to Increase by 10% in 2014

Looking at specific industries, Towers Watson’s report shows that the pharmaceutical sector will see the steepest raise in salaries. Vietnam will feel this most acutely at 12 percent, with India and China closely following at 11.5 and 8.9 percent respectively. The energy, professional services, financial services and hi-tech sectors are all also set for salary increases, although for India, financial service wages are expected to remain much the same as in 2014.

The results from the report were provided by over 300 companies from various industries in the Asia-Pacific. Overall, it shows that all the 20 countries surveyed will see an average salary increase, with improved economic growth and a lower unemployment rate across the region as a whole.

Asia Briefing Ltd. is a subsidiary of Dezan Shira & Associates. Dezan Shira is a specialist foreign direct investment practice, providing corporate establishment, business advisory, tax advisory and compliance, accounting, payroll, due diligence and financial review services to multinationals investing in China, Hong Kong, India, Vietnam, Singapore and the rest of ASEAN. For further information, please email asia@dezshira.com or visit www.dezshira.com.

Stay up to date with the latest business and investment trends in Asia by subscribing to our complimentary update service featuring news, commentary and regulatory insight.

Related Reading

Manufacturing Hubs Across Emerging Asia

In this issue of Asia Briefing Magazine, we explore several of the region’s most competitive and promising manufacturing locales including India, Indonesia, Malaysia, Singapore, Thailand and Vietnam. Exploring a wide variety of factors such as key industries, investment regulations, and labor, shipping, and operational costs, we delineate the cost competitiveness and ease of investment in each while highlighting Indonesia, Vietnam and India’s exceptional potential as the manufacturing leaders of the future.

The Gateway to ASEAN: Singapore Holding Companies

The Gateway to ASEAN: Singapore Holding Companies

In this issue of Asia Briefing Magazine, we highlight and explore Singapore’s position as a holding company location for outbound investment, most notably for companies seeking to enter ASEAN and other emerging markets in Asia. We explore the numerous FTAs, DTAs and tax incentive programs that make Singapore the preeminent destination for holding companies in Southeast Asia, in addition to the requirements and procedures foreign investors must follow to establish and incorporate a holding company.

An Introduction to Tax Treaties Throughout Asia

An Introduction to Tax Treaties Throughout Asia

In this issue of Asia Briefing Magazine, we take a look at the various types of trade and tax treaties that exist between Asian nations. These include bilateral investment treaties, double tax treaties and free trade agreements – all of which directly affect businesses operating in Asia.