By Nathan Barlow

Aug. 1 – During 2003-2011, the value of trade between the European Union (EU) and India nearly tripled from US$38.2 billion to US$105.9 billion, pushing the EU into the forefront as India’s leading trade partner. In fact, EU-India trade amounted to about 9.9 percent of India’s total bilateral trade just last year – reinforcing the EU as India’s largest trade partner. India, on the other hand, is the EU’s 9th largest trading partner.

Thanks to ongoing talks seeking a quick conclusion to a free trade agreement (FTA) between the countries, India-EU trade looks to become a defining feature of the international economic landscape.

Ongoing FTA Talks

Negotiations on the India-EU Bilateral Trade and Investment Agreement (BTIA) – which plans to eliminate duties on 90 percent of tradable goods – first began in 2007 and were set to conclude this past June. Unfortunately, however, negotiations have been stalled indefinitely due to a range of problems, and there is currently no estimated timeline for the agreement’s completion.

The issues slowing progress include the EU’s demand for India to raise its FDI cap in the insurance sector from 26 percent to 49 percent, and the EU’s demands for “data exclusivity” in India’s drug manufacturing industry.

EU Exports to India

In 2012-2013, EU exports to India totaled US$52,461 million – good for 10.7 percent of India’s total imports. However, total exports did decrease 10.3 percent year-on-year.

Despite the drop, certain EU member states have managed to increase exports to India, with Poland, Portugal and Ireland all increasing their exports by 36 percent, 22.5 percent and 12 percent year on year, respectively.

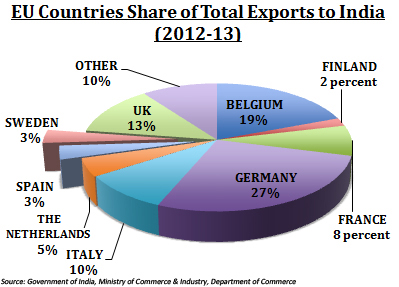

A more detailed breakdown of total exports to India from EU countries can be seen below:

Belgium’s notably high levels of exports to India can be explained by the massive demand in India for gemstones and jewelry, which accounts for 70 percent of bilateral trade between the two countries.

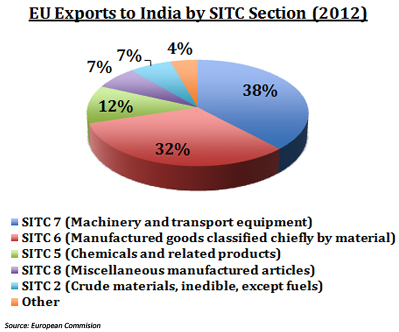

EU Exports to India by Product Grouping

Primary Products (11.4 percent):

- Agricultural Products (2.7 percent)

- Fuels and Mining Products (8.7 percent)

Manufacturers (85.7 percent):

- Iron and Steel (3.8 percent)

- Chemicals (11.6 percent)

- Other semi-manufacturers (24.8 percent)

- Machinery and transport equipment (38.0 percent)

- Textiles (0.5 percent)

- Clothing (0.2 percent)

- Other Manufacturers (6.7 percent)

Other Products (0.8 percent)

Indian Exports to the EU

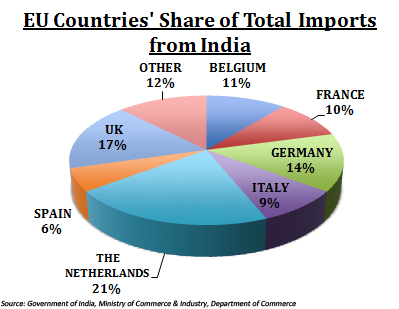

In 2012-2013, Indian exports to the EU totaled US$50,409 million, good for 16.8 percent of India’s total exports (down 4.1 percent from the year before).

Despite the drop, certain EU countries did witness an increase in their Indian imports. India’s exports to Bulgaria, Slovenia, Netherlands and the Slovak Republic grew by 44 percent, 21 percent, 15 percent and 13 percent year on year, respectively.

The Netherlands holds just 3.3 percent of the EU’s total population, yet it accounts for over 20 percent of Indian exports to the EU. This can be explained by the “gateway to Europe” relationship that Netherlands maintains with India and also its strategic proximity to other European countries.

The Netherlands is a logical geographic choice for redistribution throughout Europe with nearly 160 million people staying within a 300-mile radius of the Netherlands (roughly 60 percent of the EU’s population). As a result, many of the goods imported to the Netherlands are not always consumed there and are actually re-exported throughout the EU.

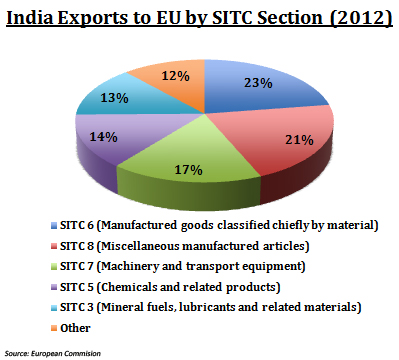

By Product Grouping

Primary Products (24.1 percent):

- Agricultural Products (9.1 percent)

- Fuels and Mining Products (15.0 percent)

Manufacturers (74.3 percent)”

- Iron and Steel (4.2 percent)

- Chemicals (14.1 percent)

- Other semi-manufacturers (12.3 percent)

- Machinery & transport equipment (17.1 percent)

- Textiles (5.7 percent)

- Clothing (12.0 percent)

- Other Manufacturers (9.0 percent)

Other Products (1.2 percent)

Dezan Shira & Associates is a specialist foreign direct investment practice, providing corporate establishment, business advisory, tax advisory and compliance, accounting, payroll, due diligence and financial review services to multinationals investing in emerging Asia. Since its establishment in 1992, the firm has grown into one of Asia’s most versatile full-service consultancies with operational offices across China, Hong Kong, India, Singapore and Vietnam as well as liaison offices in Italy and the United States.

For further details or to contact the firm, please email asia@dezshira.com, visit www.dezshira.com, or download the company brochure.

You can stay up to date with the latest business and investment trends across Asia by subscribing to Asia Briefing’s complimentary update service featuring news, commentary, guides, and multimedia resources.

Related Reading

An Introduction to Tax Treaties Throughout Asia

An Introduction to Tax Treaties Throughout Asia

In this issue of Asia Briefing Magazine, we take a look at the various types of trade and tax treaties that exist between Asian nations. These include bilateral investment treaties (BITs) and also the meatier double tax treaties (DTAs) and free trade agreements (FTAs) that directly affect businesses operating in Asia.