Aug. 22 – According to the 2013 Global Retail Development Index (GRDI), a study by the management consulting firm A.T. Kearney, China ranks fourth globally for retail development. Meanwhile, India’s retail development ranking fell nine spots from the 2012 GRDI to fourteenth overall after experiencing backlash from the global economic slowdown. A comparison of India and China’s retail sectors reveals some lessons for retailers in both markets.

China’s Continued Retail Development

China dropped in this year’s rankings from third to fourth, but it has not lost its strong attractiveness as a priority destination for the world’s retailers. China is experiencing double-digit sales growth in addition to continually increasing consumer demand.

Notably, small and medium sized retail outlets are becoming more popular in China as they accommodate the Chinese consumers’ demands for low-priced offerings in a format that caters to Chinese shopping habits. This trend is highlighted by grocery shops such as Hong Kong-based PARKnSHOP who entered China with plans to open 300 mid-sized supermarkets in the coming years. Similarly, Wal-Mart has also begun operating convenience stores throughout China as a part of its long-term strategy. Sun Art Retail Group, which operates small grocers in China, achieved a 14.3 percent increase in revenue in 2012 as a result of its aggressive expansion.

A growing trend in China is the addition of malls to the retail culture. The country currently boasts 3,100 malls and saw an increase of nearly 300 in 2012 alone. The majority of these malls were opened in China’s 2nd and 3rd tier cities where massive retail opportunities still exist to target millions of consumers.

One retail segment that has struggled in China is the luxury goods market, as many luxury brands rethink their expansion strategies in China. For example, the luxury brand Gucci slashed its annual expansion of retail outlets from 10 or 15, down to just 3 or 4.

The greatest new factor in China’s retail market is the role of e-commerce, which now accounts for up to 10 percent of retail revenue in certain categories. In 2012, total online sales exceeded US$200 billion with continued growth expected in the years to come.

Despite the advent of e-commerce, distribution and a strong brick-and-mortar presence in China are essential to a successful and thriving retail outlet. The effective utilization of real estate locations and online channels simultaneously while understanding local consumer preferences is key for long-term success in the Chinese retail market.

India’s Retail Development Falling Behind?

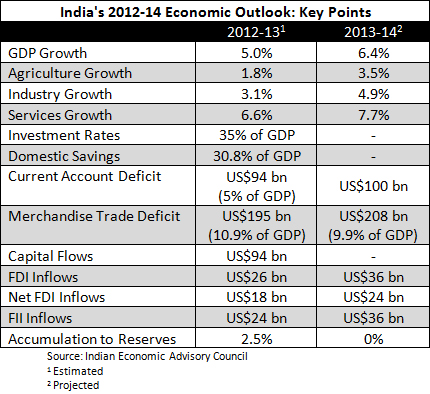

India felt the global economic slowdown and experienced a halt to its 10-year average GDP growth rate of 7.8 percent, dropping to just 5 percent in 2012. This change affected the retail sector in India with same-store sales volume growth slowing; lifestyle and value-based formats were hit hardest.

India has fallen and risen in the GRDI rankings in recent years, this year dropping from 5th down to 14th. India’s second lowest ranking was in 2002 when it ranked 6th and, in 2009, India was ranked 1st.

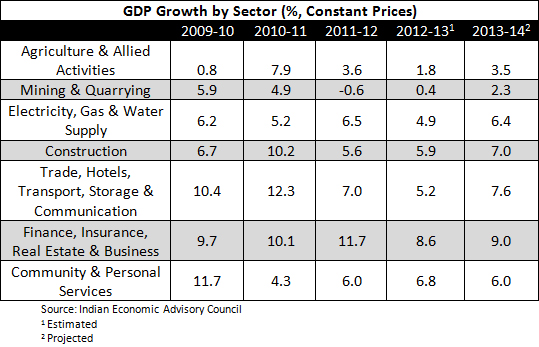

Growth in the community and personal services sector, as well as the trade, hotels and transport sector, are expected to grow at a slower rate in 2013-14 than during their high points in 2010.

The profit and expansion plans of India-based retail outlets have been affected by:

- High operating costs;

- Low bargaining power with vendors;

- Heavy discounting to improve sales;

- Real estate cost; and

- Space availability.

These factors have lead many retail outlets seeking to improve sales productivity, cutting operating costs and reducing store size.

Despite the recent slowdown in India’s retail sector, the long-term outlook is still positive. The GDRI report cites India’s “large, young, increasingly brand and fashion conscious population” as a fundamental factor in ensuring India’s continued retail success. This large pool of growing demand will be further bolstered by recent changes to India’s FDI policies for single and multi-brand retail. The current caps on FDI were raised this year, with single-brand allowing 100 percent foreign investment and multi-brand currently allowing 51 percent, with a proposed increase to 74 percent later this year.

According to the Census of India, more than 65 percent of the country’s population lives in rural India. This large population block also offers opportunities for the enterprising retail sector. Industry experts predict that it will not be long before rural India’s share of retail exceeds urban regions, as rural retail has already reached 40 percent market share. This is expected to boom now that single brand retail has been fully opened up to FDI – stores such as Adidas and IKEA, in addition to luxury brands such as Chanel and Louis Vuitton, are all expected to make aggressive inroads into India.

Tier 2 and 3 cities also offer bargain real estate prices and low operating costs compared to the high costs for shops operating in the expensive tier 1 cities. By expanding into these 2nd and 3rd tier cities, companies can lower their costs while increasing their market share.

The “bottom of the pyramid” is the driving force behind India’s retail market growth trajectory, empowered by higher education levels, greater purchasing power, increased brand awareness, and greater exposure to the Internet, according to the India Brand Equity Foundation (IBEF). The IBEF also expects government initiatives to increase rural employment and access to credit to contribute to higher consumer spending in the near future.

Given that India’s demographic advantage and liberalization of foreign investment into its retail sector is changing, the Indian market now represents an additional investment challenge and opportunity for global retailers who are used to high returns in China. The phenomena of having both markets of over 1 billion consumers each developing within 20 years is unprecedented, and retailers and their suppliers alike should be scrambling to take advantage of the Asian consumer boom these markets present.

Dezan Shira & Associates is a specialist foreign direct investment practice, providing corporate establishment, business advisory, tax advisory and compliance, accounting, payroll, due diligence and financial review services to multinationals investing in emerging Asia. Since its establishment in 1992, the firm has grown into one of Asia’s most versatile full-service consultancies with operational offices across China, Hong Kong, India, Singapore and Vietnam as well as liaison offices in Italy and the United States.

For further details or to contact the firm, please email asia@dezshira.com, visit www.dezshira.com, or download the company brochure.

You can stay up to date with the latest business and investment trends across Asia by subscribing to Asia Briefing’s complimentary update service featuring news, commentary, guides, and multimedia resources.

Related Reading

Comparison: Minimum Wages in China and India

China-India Purchasing Power and Expenditure Comparison