By Chris Devonshire-Ellis

By Chris Devonshire-Ellis

May 15 – As India begins to recover from the aftermath of what has indeed proven to be a difficult financial period, questions are now being asked as to the extent of competition India really brings to global markets when measured up against China.

In some respects, the rise of India has been greatly overshadowed by what has happened in China over the past 20 years. If the development in China had not occurred, then it would be India that would be considered the new darling of global growth. To some extent, this has enabled India to commence its own growth curves without the media attention that has been focused on China. In other ways, however, there is little doubt that the phenomenal growth of China has served to spur India into action, and to finally release the country from its moribund, 50-year hangover of independence from Britain.

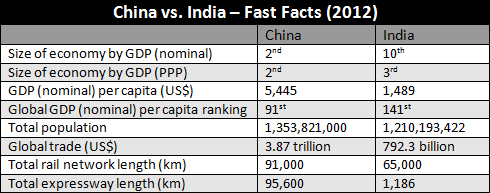

While China has largely dominated headlines, India has begun to act. In fact, over much of the past decade, India’s growth patterns have mirrored China’s at an average of about 8 percent per annum (albeit coming from a far smaller base) until the financial crisis hit. Currently, however, India’s international trade is a just a little over 20 percent of China’s. But with an economy just broken into the global top ten in terms of nominal gross domestic product (GDP), the global community is both starting to take note of India’s rise and to appreciate its clout; as well as the opportunities such power brings.

From here, despite spending twenty years behind China in the race for global trade, the demographics indicate strong support for India closing the gap. After a few troublesome years, analysts now see India’s pace of growth as accelerating, while China shows signs of slowing in certain areas.

In terms of resources, India also appears to hold some aces. Its available workforce is young, increasing, and mostly English-speaking: what some call “close to ideal demographics.” Its birthrate is higher than that of China, standing at 2.63 compared to 1.6, suggesting that future cheap global labor requirements and labor intensive industries will start to migrate. What used to be China’s main economic driver – the provision of cheap labor to service global demand – is being whittled away.

This goes hand in hand with natural resources. India possesses more arable land than China and has one of the world’s largest fishing industries. This has huge implications for the agricultural and maritime industries. If India is smart, and manages these resources properly, it will begin to emerge as a highly competitive player in these global markets. This will affect India’s domestic demand as well – increased demand for Indian agriculture will lift hundreds of millions of Indian farmers out of poverty and into meaningful consumption and wealth creation models.

Much has been made of India’s lack of infrastructure, and again, when held up against the current Chinese systems it looks ramshackle. In 2012, India’s expressways stretched over 1,000 kilometers nationwide (almost 3,500 kilometers if current construction is taken into account). Yet compared to China’s total expressway length of 95,600 kilometers, these numbers look flat. India has, however, begun to develop and invest significant amounts into building a national highway network, with the goal to add almost 20,000 kilometers of expressways by 2022.

It is worth noting where China was in similar straits in 1980. Thirty years ago, China itself had very little expressway, and most of its roads were poor quality. Today, popular routes like the Guangshen toll route between Guangzhou and Shenzhen are taken for granted, yet this was only opened in 1995, and was financed largely by a Hong Kong entrepreneur. India’s own infrastructure development curve can be expected to follow a similar pattern of development over the next twenty years.

By then, in 2030, India will have overtaken China in terms of population, and almost certainly in GDP growth rates. With an available workforce that increased by 200 million (contrasted to a projected decrease of 45 million in China), a younger population and a consumer economy of its own, India’s tortoise against China’s hare will have caught up significantly. When that happens, the bets for who will reach the finishing line as top dog by 2099 will look very different than they do today.